Opportunity Tools

& Market Intelligence

for Government Contractors

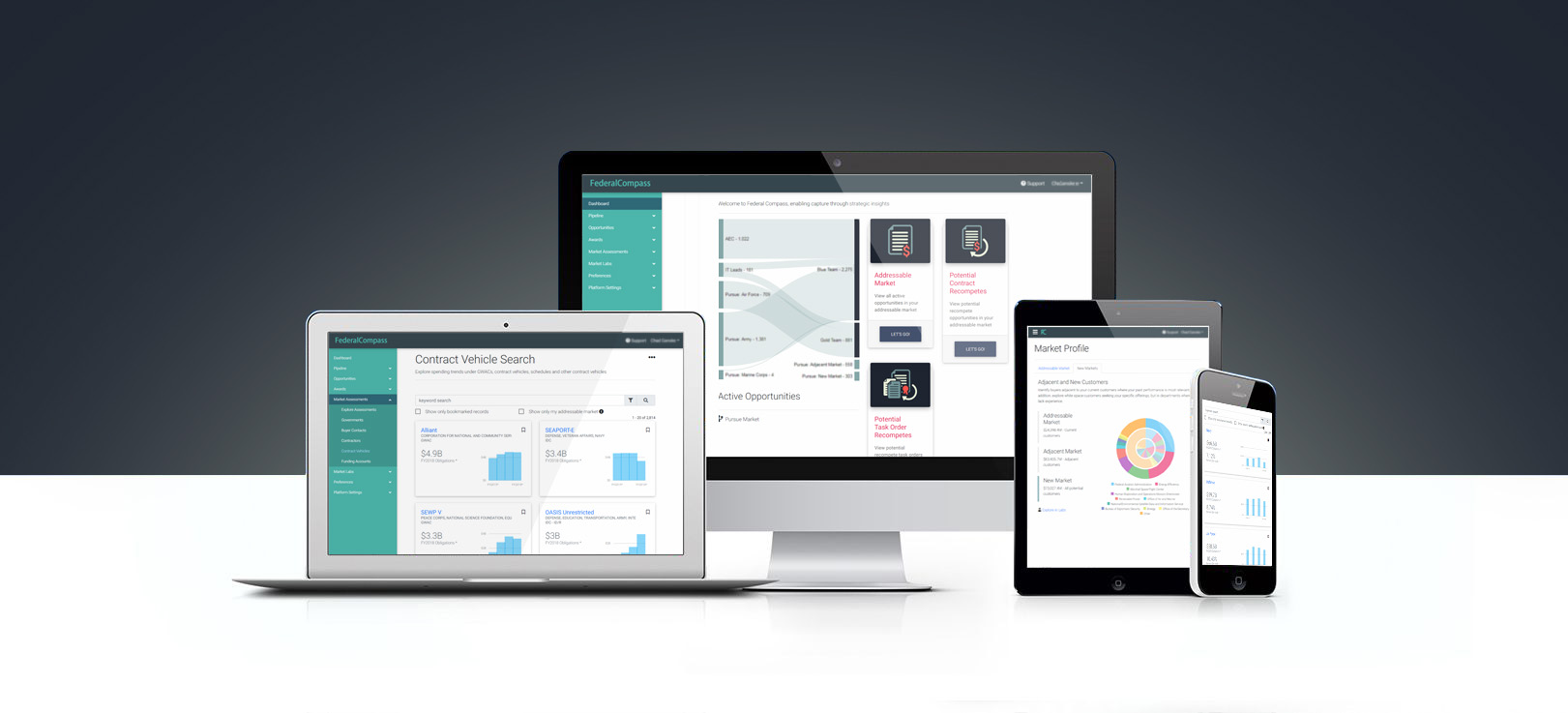

Implement your winning opportunity strategy with the most comprehensive federal market intelligence platform.

Contact Sales10/03/2019

Questions on how to navigate a successful market penetration are not limited to small businesses and start-ups. For this case study, we explore how a large corporation, with multiple subsidiaries, sought out the information to introduce private sector offerings to the public sector. With a number of their subsidiaries already active in the Federal market, they understood that finding the right fit and customers was critical to developing their penetration strategy.

A leading provider of staffing and technology services to the Federal government.

How to bring a new offering to market with limited past performance.

How to bring a new offering to the market that significantly diverged from the company’s public-sector past performance. And mitigate the lack of situational awareness that left the company ill-prepared to make an informed decision on the viability of the asset and the proper approach for penetrating the Federal market.

In developing a research approach to this problem, we determined that the contractor needed to define four variables to make an informed decision.

Critical to our customer’s information needs was the ability to isolate their targeted market and analyze only relevant spending. With Federal Compass Market Explorer, the customer was able to set the criteria for their market and conduct a comprehensive market sizing exercise using a single tool. With obligations increasing by more than $300M between FY15 and FY18, there was sufficient evidence that a thriving market existed.

With more than 600 unique customers active in their market, creating a strategy for prioritizing these customers was essential to conduct a thorough penetration analysis. The capability to display each department based on spending and the number of customers streamlined the research process by creating three distinct segments of customers. Health and Human Services, DoD, and other civilian departments.

Though the two largest segments demonstrated year-over-year growth, there were immediate red flags as to the viability of these markets. Three competitors, present in both markets, had captured more than half of all spending. And over eighty-percent of the addressable market was represented by only one of the seven lines of business that their subsidiary offered. While the third market displayed greater diversification in both competitors and demand signal for their total offerings.

After determining that the third market offered the greatest potential for successfully entering the market, the next step was knowing how to gain access. Market Explorer allowed our customer to identify the primary procurement strategies for each customer in the third segment. They found an immediate pathway through one of their GSA schedules, which accounted for over half of the addressable market. And they identified recompetes of indefinite-delivery contracts that would act as their initial pipeline.

Our customer had several options to choose from to obtain the information they needed to support their decision. They found that when compared to our competitors, Federal Compass offered the ease of single tool and greater personalization. When comparing Federal Compass to a consulting engagement, they determined that they could obtain highly customized and actionable-intelligence immediately, and at a fraction of the cost of an engagement. With Federal Compass, they effectively addressed their requirements to identify market potential, target customers, and determine pathways for customer access.