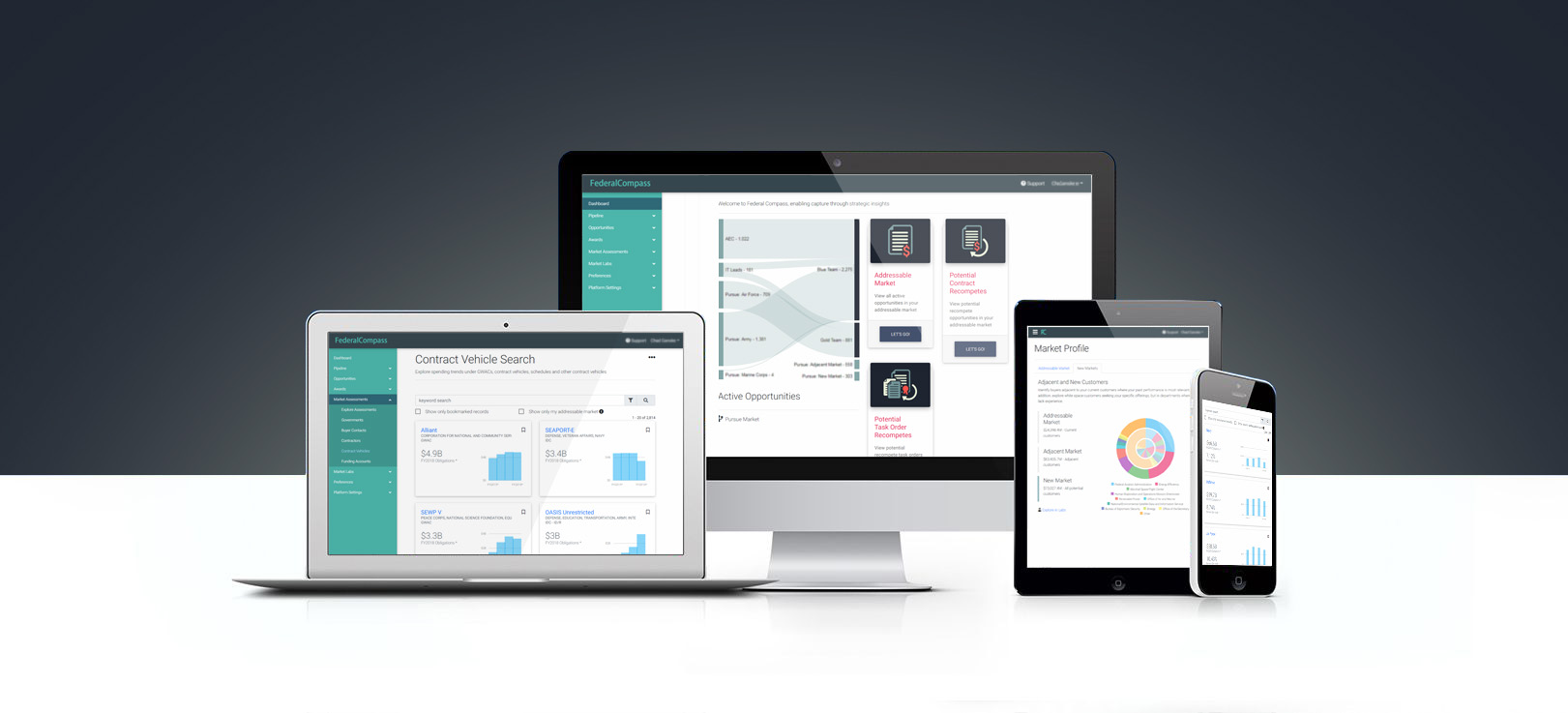

Here's how our Task Order Management process works‐start to finish.

- Task Order Connector: Automatically pulls task orders—no more manual site checks.

- Filtering & Scoring: Applies custom criteria to surface the best-fit opportunities.

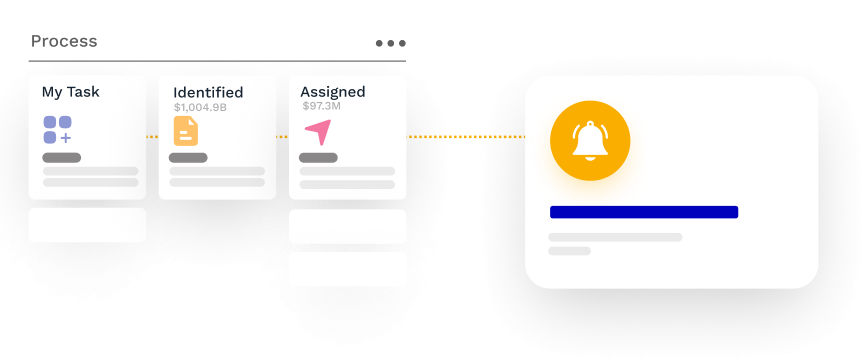

- Automation: Instantly kicks off workflows and notifies the right people.

- Collaboration & Approvals: Built-in tools keep internal and partner efforts aligned.

- Workflow & Pipeline: Tracks progress, manages accountability, and keeps leadership in the loop.