Lessons Learned from FY19

10/28/2019

The closing act of the fiscal year has come and gone. The gravity of this event starts consuming the attention of contractors as early as June, culminating in the frenzy of September. Before giving way to the first days of October that offer government and industry alike, a moment to catch their collective breath. Amid the quiet of this brief respite, are you reflecting on the past year, analyzing what went right and resolving to make this year better than the last?

We engaged our customers to help them consider their FY20 resolutions.

Resolve to be more informed

Being active within a customer was often viewed as being knowledgeable. When pressed to conduct an honest self-assessment, that mirage quickly faded away. What we found was that, in most cases, knowledge of the customer didn't extend beyond the contractor's perspective. They assumed they were doing well based on revenues or recent wins. However, they were unable to prioritize their customers based on potential or underperformance. Many were surprised to find that their assumptions rarely aligned with reality.

Our on-demand analysis of their market share, within each customer, provided the perspective to accurately gauge performance and plan for the future.

Resolve to leverage current access

When asked to review their pipeline in FY19, most could easily define wins, losses, and missed opportunities. The same level of assurance was not apparent when asked to consider the performance of their contract vehicles. Knowing what they bid on, wins and losses only painted an obscured picture of the potential. Gaining the proper context required an understanding of how active their customers had been on each vehicle. When confronted with that information, many found it necessary to reconsider how effective their post-award processes had been the previous year.

With solutions dedicated to contract vehicle transparency, we offer the information required to assess performance and maintain accountability over post-award processes.

Resolve to know competitors

Every conversation regarding competitor awareness started with confidence. After all, most contractors swim daily in the soup of competitors. It is a constant necessity to understand who will show up to threaten opportunities. The problem we encountered was that competitive knowledge often seemed to be binary. The answer of "yes" or "no" to the competitor question lacked the perspective of customers or contract pathways. With most of our customers struggling to substantiate the institutional knowledge informing their thoughts on the competitive landscape.

The ability to generate a customized competitive landscape or targeted competitor analysis offers our customers the critical information to determine the risk each competitor poses based on the customer, opportunity, or task order.

Resolve to reconsider qualification questions

Questions concerning the qualification process often displayed an intense focus on the local competition. Who would show up, and what unique risks would they pose? Falling victim to this tunnel vision prevented contractors from looking beyond the immediate to consider global threats. What seemed to catch nearly every person we spoke with off-guard, the existence of hidden competition. By ignoring competitive contracts, they missed the critical red flags that key customers were active on other contract vehicles. In many cases, those customers proved difficult to lure back to contracts, and in hindsight, that information would have had a significant impact on a bid or no-bid decision. Leading to a more effective strategic conversation about how to engage the customer.

With customer-specific insights, focused on each user's addressable market, we make it effortless to identify the risk of competitive contracts.

Our resolution

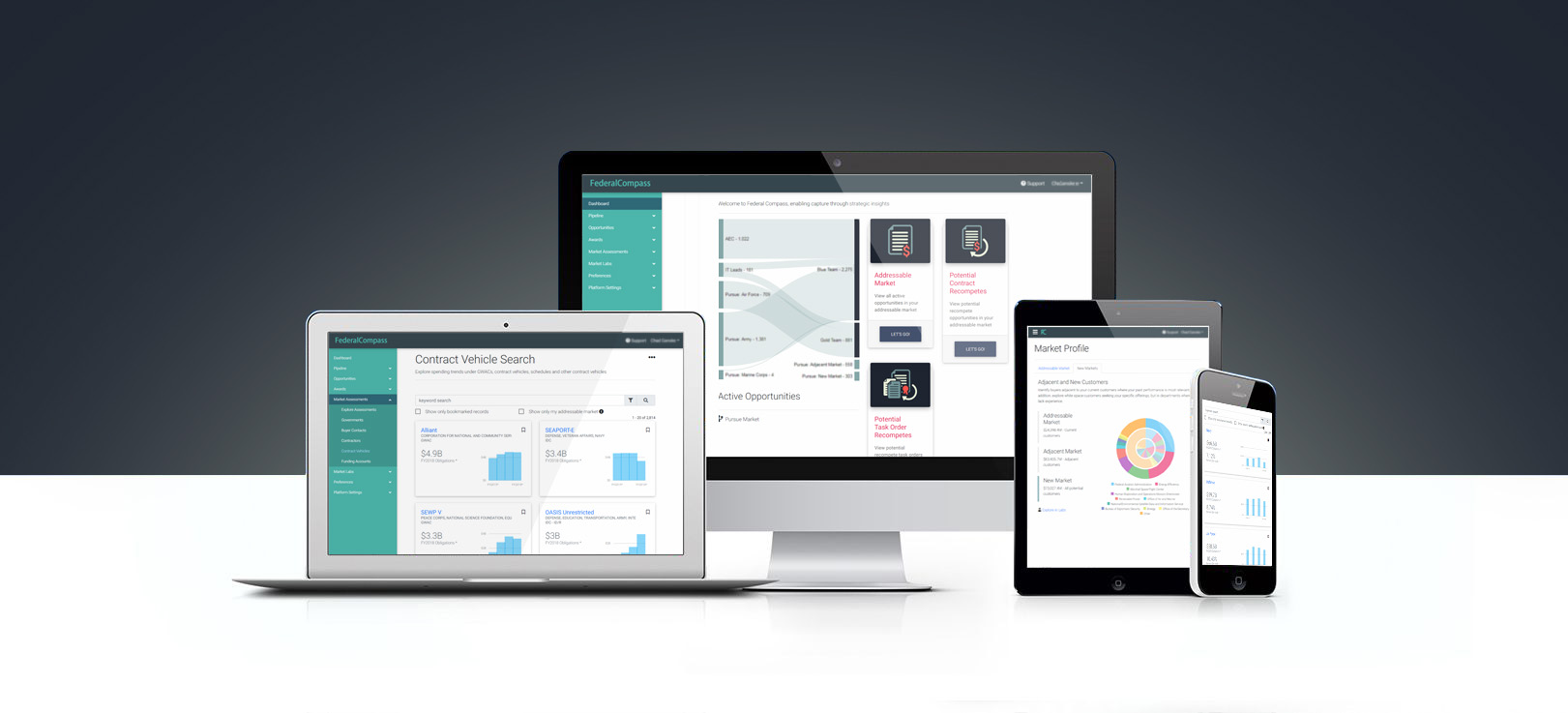

In fiscal year 2020, Federal Compass officially brought decision-intelligence to the Federal contracting market. We certainly offer market intelligence, but what makes us different is the origin of our platform. Rather than building products, we talked to industry professionals working within five distinct disciplines. Creating the blueprint for Federal Compass based on the challenges they face today. Traditional market intelligence requires the user to conduct additional analysis before applying it to decisions; our decision-intelligence platform is engineered to address 111 most common challenges faced by contractors today.

In fiscal year 2020, we resolve to disrupt the accepted status quo for market intelligence.