Are you leveraging your contract vehicles?

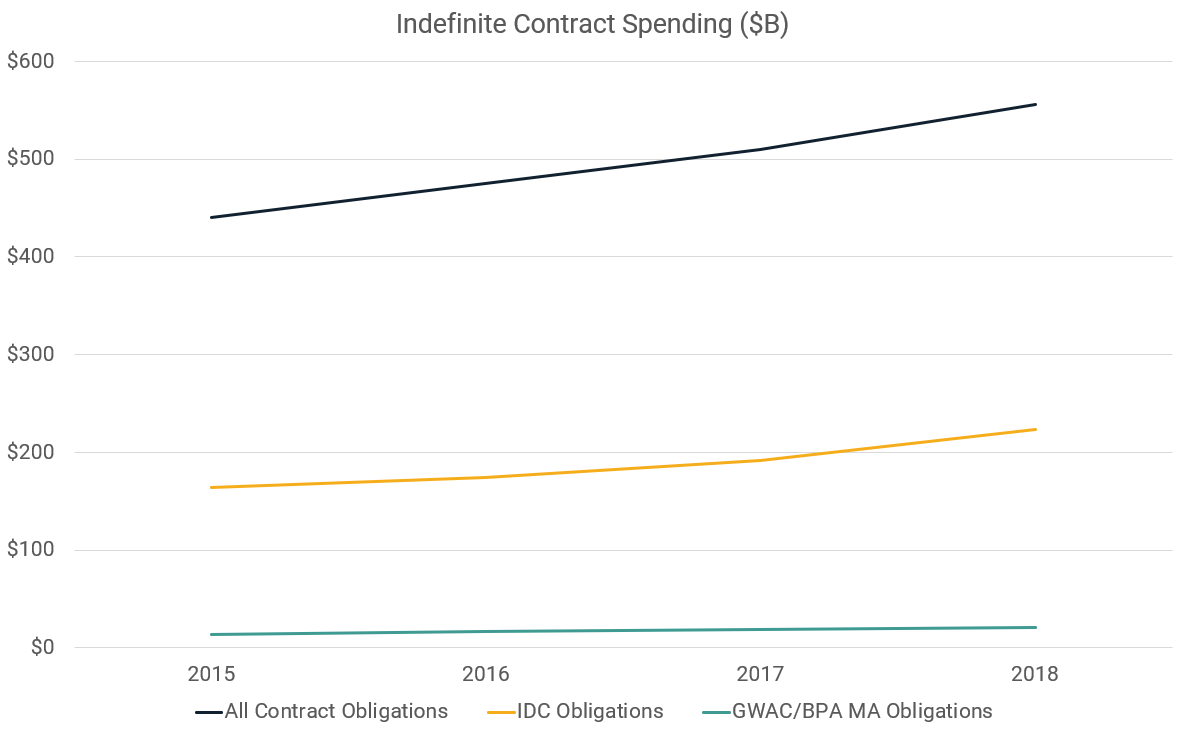

In fiscal year 2018, obligations through indefinite contracts represented 40% of all contract spending — an increase of nearly 4% over fiscal year 2016. For more than a decade, the government has promoted competition by continually shifting their buying power towards contract vehicles. Capturing prime positions on contract vehicles has become the critical component for contractor success in the federal contracting market. But it can be easy to overlook the reality that a win guarantees nothing more than a place at the table. A contractor’s ability to execute post-award determines success or failure. Below we discuss some of the most common pitfalls in the approach to pursuing and managing contract vehicles.

The new paradigm of competitive contracts

In the previous decade, you could rely on competitive transparency and targeted customers being active under your contract vehicles. Today, it is a challenge to gain the clarity you need to identify threats and predict customer activity. Contract consolidations, tighter restrictions on contract vehicles, and the emergence of GWAC and BPAs have complicated the equation.

It is no longer enough to have a contract vehicle in your pipeline. Positioning yourself for success requires you to understand your customer’s habits, identify the global view of competitive contracts, and see beyond your fellow primes to find the real threats. Knowing these variables can be the difference between a bad investment and a contract vehicle that offers positive revenue returns.

The landscape of customers

Government customers have never had more options than they have today. Even if you operate within a specialized market, there is likely a competitive contract or GWAC that is courting your customer. One of the most marginalized aspects of contract vehicles is the internal marketing conducted throughout the government. Most would agree that GSA is by far the most aggressive at marketing their services, but everyone is looking to lure in new customers. Traditional business development and marketing by contractors further exacerbates the unpredictability of government buyers.

For any contractor pursuing or holding a contract vehicle, it is imperative to understand the habits of buyers and attempt to predict who will be active. Concerns over your primary customers moving towards competitive contracts certainly raise red flags for a pursuit. But what about all the other customers who could use that contract vehicle. Are you prepared for them? Do you know who they are, or if you know them well enough to be competitive? Does your teaming strategy reflect only capability gaps, or do your subcontractors give you critical customer intimacy? Don’t expect or assume loyalty from your customers; develop a plan that aligns with reality.

Avoid unwinnable situations

Scan through a handful of contract vehicles, and you start to see a trend of underperforming contractors. They are a testament to the reality that award parties are putting the cart before the horse if you overlooked the proper due diligence. You can identify numerous reasons why a contractor has failed to gain traction on a contract, and nearly all of them were avoidable. With few exceptions, deficient post-award performance is a symptom of inadequate preparation. One of the most common is the lack of competitive awareness.

You’ve done your homework and know which customers are likely to be active. Now you can look beyond the company, their key personnel, and start to look for the abstract. Think about customer intimacy not as a signal of participation, but as a threat matrix. Who has been in those customers for 10, 15, or 20 years? Who has been walking those halls for years, talking, probing, and gaining insights that you may not have? Perhaps more importantly, whose experience has helped them learn how to write proposals targeted to those customers? They may not be anywhere near as capable as you, but their ability to write favorable proposals gives them a real advantage. And always remember that while the government would like you to forget the term ‘hardwired,’ it is still very much at play in this market.

You’ve invested, now manage the outcomes

There is nothing inexpensive about winning a contract. The personnel, money and opportunity costs are significant for companies of every size. However, the common post-award approach of wait and react does nothing to exploit these wins. Capturing task orders and generating revenue demands a proactive approach. Market to your existing customers, begin meeting with new customers, and encourage your subcontractors to do the same. While this all might seem obvious in theory, it tends to fall through the cracks when a company focuses on the next significant pursuit.

Make your contract vehicles a foundation of your strategy. Don’t win and forget, leverage these critical resources to execute against your revenue goals. Take advantage of your access by implementing lower-risk customer expansion and deepen your relationship with existing customers. Examine the practices of the most successful post-award contractors, and you will find an aggressive tactical and strategic approach to contract vehicles.