Who Uses Federal Compass?

05/18/2020

Federal Compass launched its Opportunity & Market Intelligence platform for government contractors back in 2019. Since then, we've attracted a diverse user-base, providing a broad range of product and services to the federal government. We get a lot of questions about who uses Federal Compass and what features they find most compelling. Here are some quick numbers to show just how diverse our community has become.

In total, organizations that use Federal Compass have won over $65B in federal contracting obligations in FY2019. These organizations cover industries from Aerospace & Defense to Healthcare.

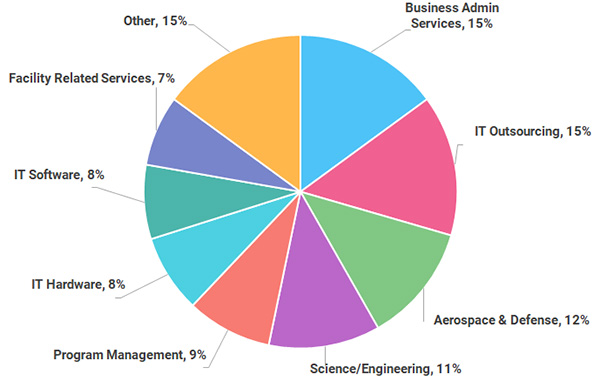

Product and service offerings of organizations that use Federal Compass.

What industries do Federal Compass users serve?

Federal Compass provides the federal contracting community with opportunity and market intelligence tools. Those contractors using Federal Compass offer a wide range of services to the federal government, everything from IT Outsourcing to Aerospace & Defense. The following chart shows how it all breaks down:

Solutions for Enterprise

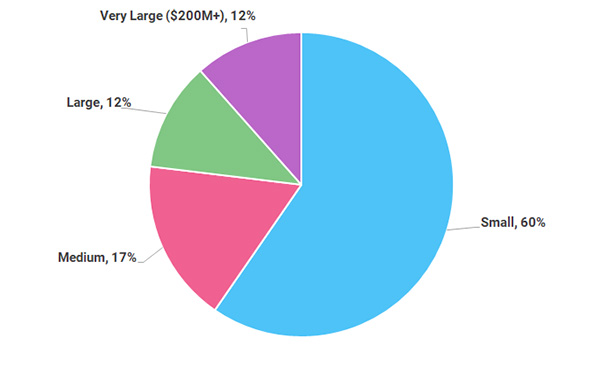

We're proud that our offering covers the range from small business to very large enterprise. We have tools purpose built for small business‒with our integrated Pipeline Tools, you won't need a separate CRM to build and manage your opportunities pipeline.

We aim for a broad enterprise footprint, facilitating not just business development and capture, but strategic activities as well. Larger organizations have unique challenges and needs in government contracting. This usually means pipelines are more strategic and pursuits are more thoughtful. We're pleased that Federal Compass has been embraced by very large enterprises with a strategy-first philosophy around opportunities. We challenge organizations to first ask "why" before pursuing an opportunity. Does this align with my strategy? Is strategy applied consistently across the organization, and what checks are in place to ensure that those responsible for execution are aligned with that vision? Federal Compass offers a robust platform serving those needs.

Organizations that use Federal Compass by enterprise size. Based on three-year average annual federal contract obligations.

Solutions for Small Business

A majority of our customers are small business contractors, some with just a single user in the system. We understand that when wearing so many different hats, small business owners and employees need the right tools to maximize productively while offering a comprehensive view of the market landscape. We also built a fully integrated set of pipeline tools so that businesses don't have to invest in a separate CRM to manage opportunities.